Top-rated Bankruptcy Attorney Tulsa Ok Fundamentals Explained

Top-rated Bankruptcy Attorney Tulsa Ok Fundamentals Explained

Blog Article

All About Top Tulsa Bankruptcy Lawyers

Table of ContentsBankruptcy Lawyer Tulsa Can Be Fun For AnyoneThe 3-Minute Rule for Tulsa Ok Bankruptcy AttorneyGetting The Affordable Bankruptcy Lawyer Tulsa To WorkNot known Incorrect Statements About Chapter 7 Vs Chapter 13 Bankruptcy The Ultimate Guide To Tulsa Bankruptcy Consultation

The stats for the various other primary kind, Phase 13, are also worse for pro se filers. (We break down the differences in between the two enters deepness below.) Suffice it to state, talk to a legal representative or two near you that's experienced with bankruptcy regulation. Below are a few resources to discover them: It's easy to understand that you could be hesitant to spend for a lawyer when you're currently under substantial financial stress.Several attorneys likewise offer complimentary appointments or email Q&A s. Make the most of that. (The charitable app Upsolve can assist you find cost-free examinations, sources and lawful help release of fee.) Ask them if personal bankruptcy is without a doubt the appropriate option for your circumstance and whether they believe you'll qualify. Before you pay to file personal bankruptcy forms and acne your credit history report for as much as ten years, inspect to see if you have any sensible options like debt negotiation or charitable credit scores therapy.

Ad Now that you've chosen personal bankruptcy is certainly the appropriate training course of activity and you with any luck removed it with an attorney you'll need to obtain begun on the paperwork. Before you dive right into all the official personal bankruptcy kinds, you ought to get your own papers in order.

Tulsa Ok Bankruptcy Attorney Things To Know Before You Get This

Later on down the line, you'll actually need to verify that by divulging all types of info regarding your financial events. Below's a standard checklist of what you'll need when driving in advance: Determining papers like your driver's certificate and Social Safety card Tax obligation returns (as much as the previous 4 years) Evidence of income (pay stubs, W-2s, self-employed revenues, income from assets along with any type of income from federal government advantages) Financial institution statements and/or pension statements Evidence of worth of your properties, such as automobile and property appraisal.

You'll desire to comprehend what type of financial debt you're trying to deal with.

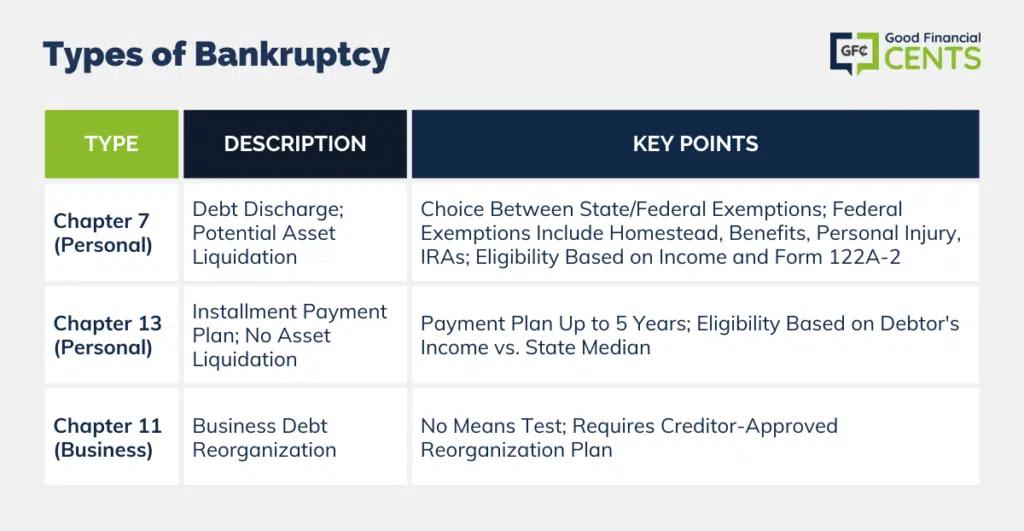

You'll desire to comprehend what type of financial debt you're trying to deal with.If your earnings is too expensive, you have another alternative: Chapter 13. This choice takes longer to settle your financial debts since it calls for a long-lasting repayment strategy usually 3 to five years before some of your remaining financial obligations are wiped away. The filing procedure is also a whole lot a lot more complicated than Chapter 7.

Chapter 13 Bankruptcy Lawyer Tulsa - Truths

A Phase 7 personal bankruptcy remains on your credit rating record for one decade, whereas a Chapter 13 insolvency falls off after 7. Both have enduring influence on your debt score, and any kind of brand-new financial obligation you take out will likely include higher rates of interest. Prior to you send your personal bankruptcy forms, you should first finish an obligatory program from a credit history counseling company that has been approved by the Division of Justice (with the remarkable exemption of filers in Alabama or North Carolina).

The training course can be completed online, in individual or over the phone. Training courses generally set you back in between $15 read this and $50. You must complete the program within 180 days of declare insolvency (Tulsa bankruptcy attorney). Use the Division of Justice's website to discover a program. If you live in Alabama or North Carolina, you have to pick and finish a program from a list of separately accepted providers in your state.

Some Known Incorrect Statements About Which Type Of Bankruptcy Should You File

Examine that you're filing with the proper one based on where you live. If your copyright has actually moved within 180 days of filling, you should file in the area where you lived the greater portion of that 180-day period.

Normally, your insolvency lawyer will work with the trustee, but you may need to send the person documents such as pay stubs, tax returns, and financial institution account and credit rating card statements directly. A common misconception with insolvency is that when you submit, you can quit paying your debts. While insolvency can assist you clean out numerous of your unsafe financial obligations, such as past due clinical costs or personal lendings, you'll desire to keep paying your month-to-month settlements for secured financial obligations if you desire to keep the residential property.

The Greatest Guide To Which Type Of Bankruptcy Should You File

If bankruptcy lawyer Tulsa you go to threat of repossession and have actually exhausted all other financial-relief alternatives, after that submitting for Chapter 13 may postpone the foreclosure and assistance conserve your home. Inevitably, you will still need the earnings to proceed making future home mortgage settlements, in addition to settling any late payments over the program of your payment strategy.

The audit might delay any kind of debt relief by several weeks. That you made it this much in the procedure is a decent indicator at the very least some of your financial debts are eligible for discharge.

Report this page